[vc_row][vc_column][vc_column_text]With home prices continuing to rise, some are concerned we’re in a housing bubble like the one in 2006. However, a closer look paints a completely different picture…here’s why.

Homeowners aren’t refinancing their homes

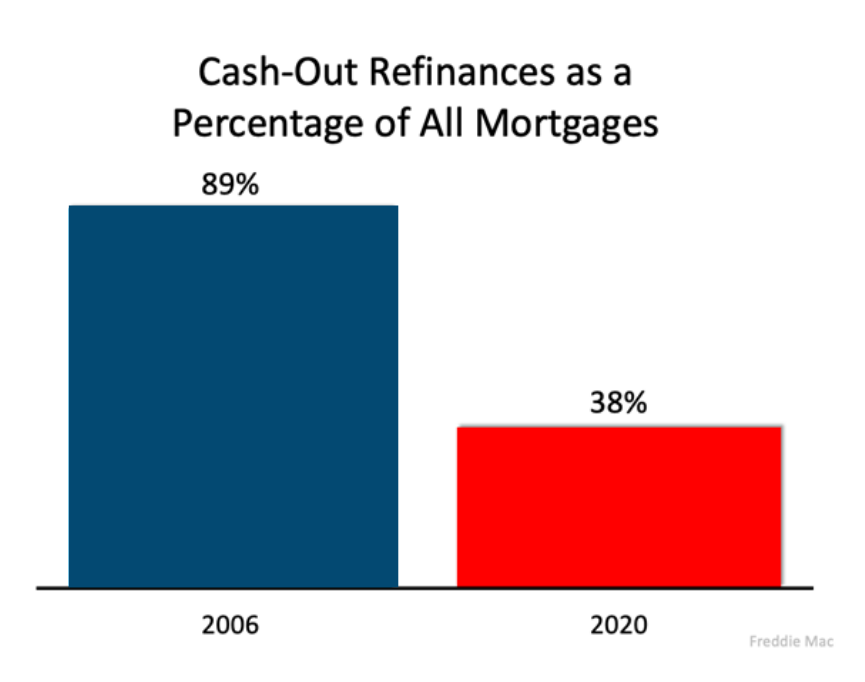

During the housing bubble in 2006, people were refinancing their homes and pulling out large sums of cash as home prices skyrocketed. As prices began to fall, that caused many to spiral into a situation where their mortgage was higher than the value of the house.

Today, homeowners are letting their equity build. Tappable equity is the amount available for homeowners to access before hitting a maximum 80% combined loan-to-value ratio. In 2006, that number was $4.6 billion. Today, that number stands at over $8 billion. Yet, the percentage of cash-out refinances is half of what it was in 2006.

The housing market isn’t driven by risky mortgage loans.

Back in 2006, nearly everyone could qualify for a loan. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association is an indicator of the availability of mortgage money. The higher the index, the easier it is to obtain a mortgage. The MCAI more than doubled from 2004 to 2006. Today, the index stands at 130.

Today, loans with high-risk features are absent and mortgage underwriting is prudent.

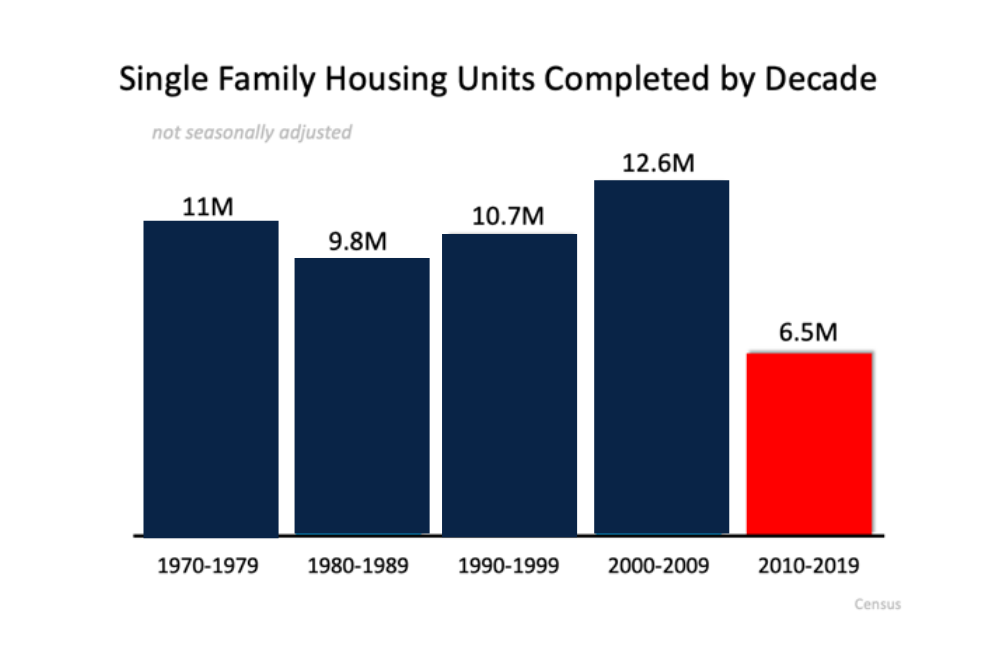

It’s a matter of supply and demand.

In 2006, many homeowners put their houses on the market, as evidenced by the over seven months’ supply of existing housing inventory available for sale in 2006. Today, that number is barely two months. Builders also overbuilt during the 20016 bubble but pulled back significantly over the next decade. That pullback is the major factor in the lack of available inventory today. Ultimately, The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.

All in all, this market is nothing like 2006. If you have questions or concerns about your next move in this market, connect with a trusted realtor today!

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][wpforms id=”6993″ title=”false” description=”false”][/vc_column][/vc_row]