[vc_row][vc_column][vc_column_text]If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers competed with one another to be the winning offer.

But what was once your greatest challenge may now be your greatest opportunity. Today, data shows buyer demand is moderating in the wake of higher mortgage rates. Here are a few reasons why this shift in the housing market good news for your homebuying plans is.

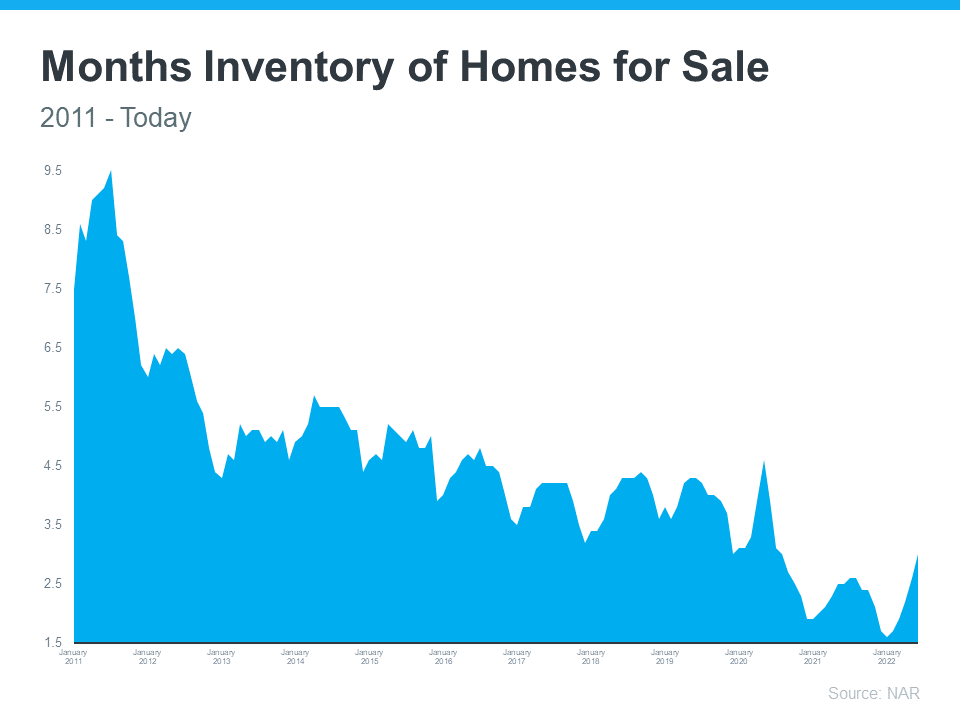

There were many reasons for the limited number of homes on the market during the pandemic, including a history of underbuilding new homes since the market crash in 2008. As the graph below shows, housing supply is well below what the market has seen for most of the past 10 years (see graph below):

But that graph also shows a trend back up in the right direction this year. That’s because moderating demand is slowing the pace of home sales and that’s one of the reasons housing supplies is finally able to grow. For you, that means you’ll have more options to choose from, so it shouldn’t be as difficult to find your next home as it has been recently.

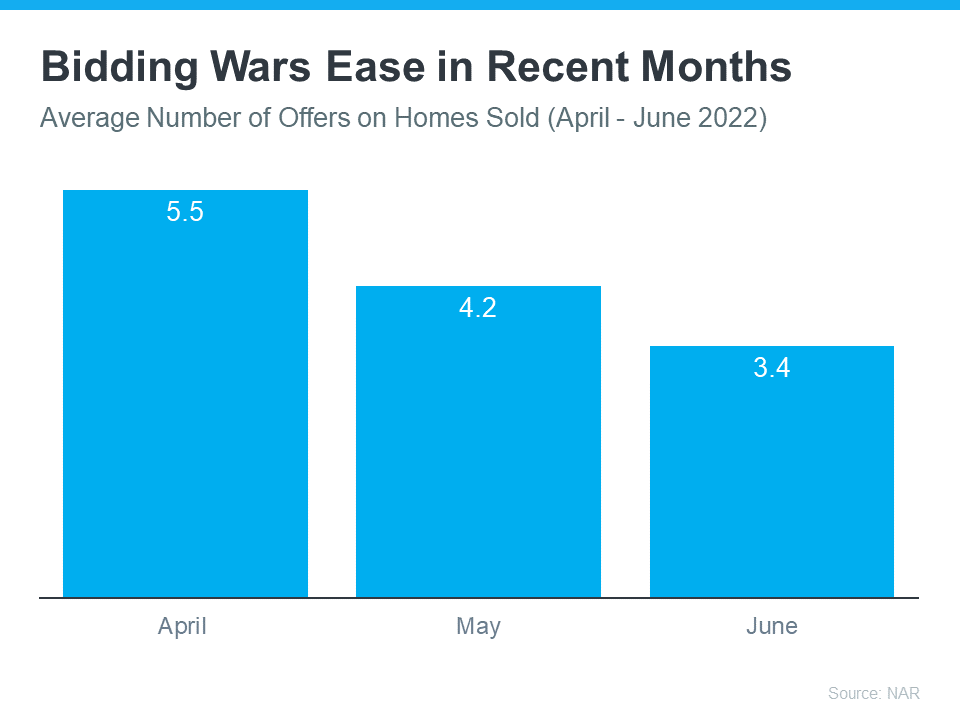

And having more options may also lead to less intense bidding wars. Data from the Realtors Confidence Index from the National Association of Realtors (NAR) shows this trend has already begun. In their recent reports, bidding wars are easing month-over-month (see graph below):

If you’ve been outbid before or you’ve struggled to find a home that meets your needs, breathe a welcome sigh of relief. The big takeaway here is you have more options and less competition today.

Just remember, while easing, data shows multiple-offer scenarios are still happening – they’re just not as intense as they were over the past year. You should still lean on an agent to guide you through the process and help you make your strongest offer up front.

If you’re still looking to make a move, it may be time to pick your home search back up today. Let’s connect to kick off the homebuying process.[/vc_column_text][/vc_column][/vc_row]